The day I opened the letter felt like any other. I walked to the mailbox, grabbed the pile of envelopes, and shuffled back inside. As I sifted through the stack, one ominous white envelope caught my eye. My name and address were typed in bold, professional font. I immediately knew it was not going to be good news. It was about my Credit Card Debt.

With trembling hands, I tore open the envelope. My anxiety was confirmed as I read the contents: My credit card payment was 60 days past due and they would be turning my account over to collections if I did not pay soon.

My breath caught in my throat. I had been avoiding looking at my bank account balance for weeks since my hours got cut at work. Now reality was staring me in the face.

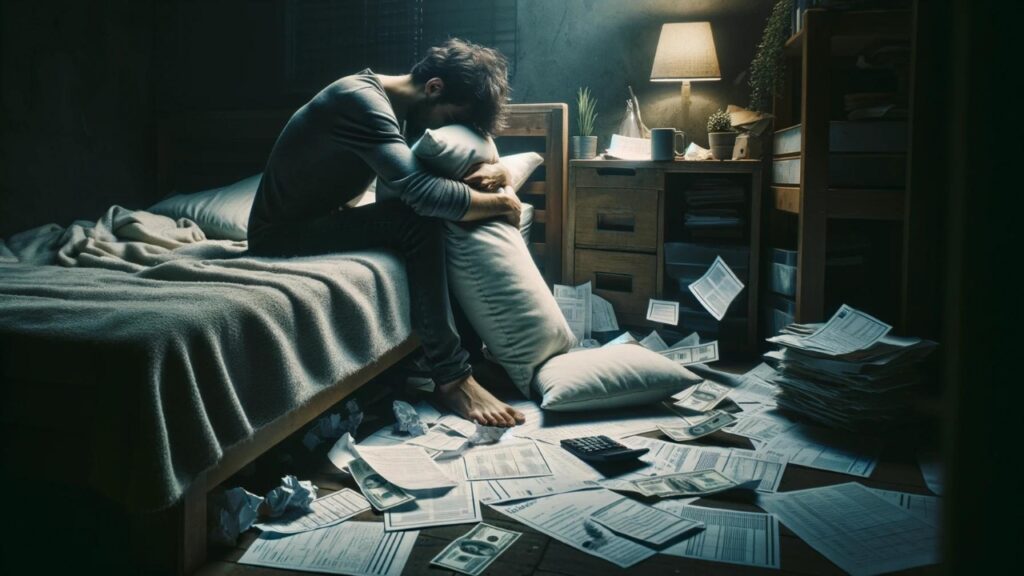

I sank down onto the couch as waves of panic washed over me. What was I going to do? I had no savings and was barely scraping by each month. Now a collection agency would be hounding me too?

As I sat there with my head in my hands, I thought about all the times I had felt that same panicked helplessness. The car repair I couldn’t afford. The medical bill I had to put on a credit card. How was I ever going to dig myself out of this hole?

That letter was a turning point for me. It forced me to finally face the truth about how debt was affecting my mental health. I knew I couldn’t keep living like this. I decided right then and there that I had to make a change before debt crushed my spirit completely.

Looking back now, I had no idea then just how heavy the burden of debt can become. Financial struggles affect every part of your life. Your relationships, career, health – nothing is left untouched.

When I think about the constant, grinding stress I used to be under, it seems incredible that I survived it. The lack of sleep, withdrawing from friends and family, not even wanting to check the mail or answer my phone. Debt colors everything when you feel like you’ll never escape it.

But there is hope, even in the darkest of times. The path to freedom seems impossible until you take the first step. My journey was long and difficult, but so worth it.

Now I want to share my story, to help others caught in the vicious debt cycle see that there is light ahead. No matter how deep the hole, you can climb out if you keep striving upward – one step at a time.

Contents

The Early Signs of Credit Card Debt

In retrospect, the seeds of my debt crisis were planted years before that collections notice arrived. But at the time, I didn’t recognize the subtle shifts in my attitude and behavior.

Looking back, I can see now how it started impacting my mental health in small ways first. I was just so focused on survival that I didn’t even notice the toll it was taking.

As a single mom, I was always stretching my paychecks from my receptionist job at a dental office as far as they could go. I made just enough to cover our basic expenses if I was careful.

Occasionally, an unexpected cost like new shoes or a school field trip would force me to whip out my credit card. But I always paid off the balance quickly.

After my daughter’s father and I split when she was 3, money was even tighter. Still, we managed okay. Until she turned 16 and I had to get her a used car for school and work. Even an old Civic put a $300 monthly car payment strain on my limited budget.

I’ll never forget coming out of the dealership with that first car payment book in my hand. I stared at it and just kept thinking: “How am I going to do this every month now too?”

That’s when the sleepless nights started. I’d run budgets over and over in my head, trying to find some wiggle room that didn’t exist. Exhausted, I’d go to work like a zombie.

When anything else came up warranting a credit card charge – car repairs, auto insurance, medical copays, appliances breaking – I just told myself I’d increase the monthly payment. Of course, that never actually happened.

Slowly, steadily, the credit card balances crept higher. I hardly noticed it happening. Until that collections notice arrived, I didn’t realize what a heavy burden I had taken on.

You may also like: How to Choose a Credit Card That Works As Hard As You Do

Hitting Rock Bottom

They say it has to get bad before it can get better. Well, let me tell you, when you hit financial rock bottom it feels like you’re in a black hole collapsing in on itself.

The collection calls started coming every other day. I’d see the toll-free number on caller ID and feel my heart speed up. Usually, I just let it go to voicemail, too anxious to actually talk to them.

When I couldn’t avoid it any longer and finally answered, I could barely keep from breaking down as the agent told me all the ways my life would become miserable if I didn’t pay up.

But I literally had no money to send them. I was already juggling bills and late notices each month. My credit card balances kept creeping higher, despite my minimum payments.

I considered getting a second job, but then what would happen with my daughter? She was thriving in high school and I didn’t want her to have to be home alone more.

I felt utterly stuck. I couldn’t see a way out and it was sending me into a downward spiral emotionally.

I withdrew from friends and family, afraid that being around happy people would highlight how miserable I felt. I started having frequent headaches and stomach troubles, which I later realized were from stress.

What little energy I had left went to holding myself together at work. The moment I got home I’d collapse on the couch, depleted. Weeks went by where my daughter and I barely had a real conversation.

She knew something was very wrong, but I couldn’t bring myself to tell her how bad things had gotten. I was her sole provider – I didn’t want her to worry that I’d completely failed her.

I was also terrified that if I said it all out loud, I’d have a full breakdown. So I bottled it up, which only made the isolation and hopelessness more oppressive.

You may also like: How to Get Your First Credit Card

Turning Toward the Light

The turning point came late one night when I stumbled onto a website for a nonprofit credit counseling agency. I have no idea what made me search for something like that, except I was grasping desperately for anything to ease my panic.

As I read about people turning their financial lives around with guidance from credit counselors, a tiny flicker of hope stirred inside me. Could this be a way out?

I booked an appointment with a counselor for the next morning. I barely slept, my mind racing with possibilities.

Sitting in the counselor’s kind, non-judgmental presence 20 hours later, the floodgates opened. I spilled my whole sad story and showed her all the bills.

Finally admitting out loud that I was drowning financially was at once terrifying and cathartic. For the first time in months, I cried tears of relief instead of despair. This person listened, didn’t judge me, and said she could help.

Those positive affirmations were what I needed most to start healing emotionally and regaining my mental strength. I left her office feeling lighter than I had in years.

With my counselor’s assistance, I worked out a manageable budget to stabilize my finances. She got my creditors on board with affordable repayment plans to start digging me out of the hole.

I found better paying work closer to home. My daughter also took an after-school job to help a bit with her expenses.

Getting completely out of credit card debt took several years of steady effort. But just having a path forward did wonders for my mental state. The vise grip of fear and uncertainty had been broken.

You may also like: My Journey to Financial Freedom with Credit Card Rewards

Credit Strategies for a Healthier Life

My journey has taught me so much about money, mental health, resilience and hope. I want to pass on what I learned to anyone finding themselves weighed down by financial burdens of Credit Card Debt.

- You are not alone: First, know that you are not alone. Money issues touch most people at some point in life. Being ashamed keeps the problem hidden away, spreading darkness. Shine light on it by opening up to someone you trust. Let at least one person into your pain – it will ease the isolation.

- Get Help: Don’t wait to get help like I did. If debt is affecting your mood, sleep, appetite or relationships, take action quickly before it sinks deeper. See a doctor, contact a credit counselor, join a support group – do something to turn the ship around soon.

- Track your spending: When tackling credit card debt, start with one small step forward. Maybe it’s tracking your spending for a week or setting up automatic payments on bills. A journey of 1000 miles begins with one step. Momentum builds as you experience those first small successes.

- Learn from mistakes: Learn from setbacks or delays and be gentle with yourself. Recovery is not linear. When you stumble on the path, get back up and keep striving. Every step forward, no matter how small, is still progress.

- Have Patience and Hope: Finally, hold onto hope, even when it seems dim. To climb out of any hole, you must believe there is a way up into the light again. When doubt clouds my mind now, I remember how far I’ve come. The woman who opened that collections notice years ago never would have imagined I could feel such peace today.

If I did it, you can do it. My heart is with you, shining light on your path until you find your way through to the other side. You’ll get there. Just keep climbing.